Yesterday an anonymous comment on the Political Environment blog offered some updated info on the Sawyer Road/ Hwy. P interchange planned as frosting on the cake of Pabst Farms housing development, Aurora Summit Hospital and a vaporous, hallucinated "Regional Destination Shopping Mall".

We learned that the $20+ million upgrade to the I-94 Hwy P interchange is ready to begin--contracts let, and ready to go. Also, that Pabst Farms housing development has returned the huge swathes of land intended to be for the more pricey (phase II) and insanely pricey (Phase III) enclaves of the Pabst Farms Experience back into plain old farm land. This lets them pay less real estate taxes on what formerly was designated as residential land.

Good news it is--the part about the re-classified land. But... The DOT's I-94 and Sawyer Road interchange foolishness is NOT yet planned, NOT under contract and NOT about-to-happen as the commenter mistakenly stated yesterday. (hey, it's hard to keep up with this moving target).

But it is in the plans, bigger than ever, just shoved off until later. That's ok; that's good news. Means we still have opportunities to comment , criticize and harpoon the DOT plan to waste money trying to prop up Pabst Farms and Aurora Summit.

.

Here's what is in the actual 2011 plan:

1. Resurfacing I-94 for one half mile east and one half mile west of Hwy P (Sawyer Rd.) at a cost of $1.3 million is to happen in 2011. Project # 406 in the SEWRPC Preliminary Transportation Improvement Plan, 2011-2012.

2. Also in the 2011 plan is Project #404: a Park and Ride Lot at Sawyer Rd and I 94. This is a planning expenditure only. It is redundant; there is a park and ride lot at Hwy 67, just a bit more than one mile from Hwy P.

And, here's the elephant in the living room:

3. Project #436: They'll spend $1.92 million just on the planning of "Reconstruction of I 94, Hwy P interchange, adding an East-bound off-ramp and a West-bound on-ramp".

The nearly $9 million that was spent two years ago acquiring land and doing initial clearing, grubbing and crossovers, now has added to it $1.3 million in resurfacing I 94 around the interchange.

They have spent/committed a total of about $12 million on this boondoggle in support of the dying-mostly-dead development at Pabst Farms, Aurora Summit Hospital and a laughable Regional Shopping "Destination".

Sensible people need to get together a coordinated plan to get Scotty fired up about saving money / balancing the budget by dumping this ill-conceived and wasteful highway boondoggle, daring him to keep funding this clown act while the State of Wisconsin is mired in deficits.

Tuesday, January 11, 2011

For lots of young adults a couple years out of school the big question to somebody they like a lot: " How much school debt are you carrying?"

The housing crisis is not going to resolve itself. Not next year, not under the next President, not even when housing prices sink to the level where they are in rough sync with incomes...for those who have incomes.

Why not?

Because a couple of generations of college grads-with-debt-up-the-wazoo and years--nay, decades--of underemployment under their belts will have saved nothing, zero, zilch to use as a down-payment on a nicelittle monstrosity of a tract mansion at the far reaches of suburbia.

More than twenty five percent of college graduates in Califormia are deemed to be underemployed, working at jobs that do not validate the fast-disappearing notion that higher education is the ticket to middle class income and prospects. The trend in most other states is likely headed toward Calfornia's numbers.

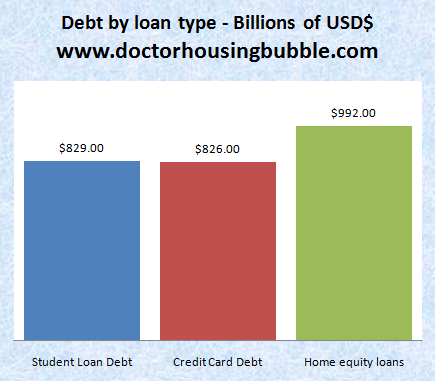

In this chart--from the amazing and prescient Dr. Housing Bubble--we see that aggregate U.S. credit card debt, which used to be just shy of a trillion, is shrinking, shrunk to less than the aggregate total of school debt. Lots of bankruptcies have resulted in banks writing off huge amounts of the card debt. But the school loans go on forever; there's no escape; the interest keeps mounting, no forgiveness even in bankruptcy. Legions of alumni will take huge balances on their owings, along with those memories of school days, to the grave.

Not everybody will will be in this pickle. But, if only 20 percent of those who would have in the past started shortly after graduation on buying starter houses, then moving up the domicile ladder are mired in education loans, they'll drag down, demolish, drown the whole market.

Just at the moment when huge numbers of baby boomers are unloading their big suburban--and even their modest-but-still-very-nice*--abodes, there will be a whole lot of people with high hopes and no-chance. Tough lending standards and 20% downpayments are going to be beyond the reach of a significant number. And this will kill the real estate market by driving prices down, down, down.

Suburban dreams are fading fast already. Many of the young and young-ish who are presently minimally set to buy real estate are leery of diving into the suburban lifestyle. Four hours every weekend of riding a mower, long commutes on deteriorating (asphalt is, after all, just another word for petroleum) roads. While their fathers were practicing lawn-adoration, they were inside tuning in and turning on to the prospect of living where Friends and Seinfeld lived--urban apartments.

* Even Casa Waterblogged will be for sale when the crocuses reappear, as the residents plan a move back to Milwaukee

Why not?

Because a couple of generations of college grads-with-debt-up-the-wazoo and years--nay, decades--of underemployment under their belts will have saved nothing, zero, zilch to use as a down-payment on a nice

More than twenty five percent of college graduates in Califormia are deemed to be underemployed, working at jobs that do not validate the fast-disappearing notion that higher education is the ticket to middle class income and prospects. The trend in most other states is likely headed toward Calfornia's numbers.

In this chart--from the amazing and prescient Dr. Housing Bubble--we see that aggregate U.S. credit card debt, which used to be just shy of a trillion, is shrinking, shrunk to less than the aggregate total of school debt. Lots of bankruptcies have resulted in banks writing off huge amounts of the card debt. But the school loans go on forever; there's no escape; the interest keeps mounting, no forgiveness even in bankruptcy. Legions of alumni will take huge balances on their owings, along with those memories of school days, to the grave.

Not everybody will will be in this pickle. But, if only 20 percent of those who would have in the past started shortly after graduation on buying starter houses, then moving up the domicile ladder are mired in education loans, they'll drag down, demolish, drown the whole market.

Just at the moment when huge numbers of baby boomers are unloading their big suburban--and even their modest-but-still-very-nice*--abodes, there will be a whole lot of people with high hopes and no-chance. Tough lending standards and 20% downpayments are going to be beyond the reach of a significant number. And this will kill the real estate market by driving prices down, down, down.

Suburban dreams are fading fast already. Many of the young and young-ish who are presently minimally set to buy real estate are leery of diving into the suburban lifestyle. Four hours every weekend of riding a mower, long commutes on deteriorating (asphalt is, after all, just another word for petroleum) roads. While their fathers were practicing lawn-adoration, they were inside tuning in and turning on to the prospect of living where Friends and Seinfeld lived--urban apartments.

* Even Casa Waterblogged will be for sale when the crocuses reappear, as the residents plan a move back to Milwaukee

Subscribe to:

Comments (Atom)

Blog Archive

-

►

2018

(1)

- ► August 2018 (1)

-

►

2014

(1)

- ► October 2014 (1)

-

►

2012

(15)

- ► December 2012 (1)

- ► October 2012 (2)

- ► August 2012 (2)

- ► March 2012 (4)

- ► February 2012 (1)

-

▼

2011

(25)

- ► October 2011 (2)

- ► September 2011 (6)

- ► April 2011 (6)

- ► March 2011 (3)

- ► February 2011 (2)

-

►

2010

(31)

- ► December 2010 (2)

- ► November 2010 (2)

- ► October 2010 (1)

- ► September 2010 (10)

- ► August 2010 (4)

- ► April 2010 (1)

- ► February 2010 (2)

- ► January 2010 (3)

-

►

2009

(58)

- ► December 2009 (5)

- ► November 2009 (4)

- ► October 2009 (4)

- ► September 2009 (3)

- ► August 2009 (11)

- ► April 2009 (5)

- ► March 2009 (12)

- ► February 2009 (2)

- ► January 2009 (5)

-

►

2008

(50)

- ► December 2008 (1)

- ► November 2008 (3)

- ► October 2008 (6)

- ► September 2008 (6)

- ► August 2008 (3)

- ► April 2008 (5)

- ► March 2008 (11)

- ► February 2008 (2)

- ► January 2008 (2)

-

►

2007

(43)

- ► December 2007 (5)

- ► November 2007 (5)

- ► October 2007 (6)

- ► September 2007 (3)

- ► August 2007 (5)

- ► April 2007 (3)

- ► March 2007 (2)

- ► February 2007 (1)

About Me

- Jim Bouman

- Of the biblical allotment of three score and ten I have lived only three of them more than a bicycle ride from one of the Great Lakes. I grew up ten blocks from Lake Erie in the (once Irish/Italian ghetto, now newly-hip) "Near West Side" of Cleveland. I can still cycle to the Milwaukee lakefront in an hour and a half; but, a round-trip has always been more than I would (noror ever did) attempt. -0- I'm a "...somewhat combative pacifist and fairly cooperative anarchist," after the example of Grace Paley (1922-2007). -0- I'm always cheerful when I pay my taxes (having refused--when necessary--to pay that portion of them dedicated to war). -0- And I always, always vote.